|

Jump to:

Don’t Put Off Until Tomorrow What You Really Need Today

Take advantage of the financial flexibility of lease-financing. Lease-Financing provides you all of the benefits of food service, warewashing, and janitorial equipment ownership without the high upfront costs allowing you to purchase the time- and cost-saving equipment you need today to help your business.

Start Lease-Financing Your Equipment Today!

Contact us at customer-service@regdist.com or (585) 458-3300 between 8:30 a.m. - 5:00 p.m., Monday through Friday.

* All lease-finances are subject to credit approval. Please contact us for more information.

What are the benefits of lease-financing equipment with Regional Distributors?

Lease-financing gives you all the benefits of food service, warewashing, and janitorial equipment ownership without the prohibitive up-front costs; you won’t have to put off until tomorrow what you really need today to help your business. Plus, lease-financing versus buying offers you the opportunity for improved cash flow and potential tax advantages.

Additional benefits include:

- Fast approvals within 2 business days.

- Easy application and simple approval process.

- Quick funding and competitive rates.

- Less money down and affordable monthly payments.

- Industry and technology flexibility allowing you to stay relevant and meet today’s customers’ expectations.

- Tax-deductible as an operating expense or fully depreciable, depending on the structure of your lease.

What types of equipment and products can I lease-finance?

Some of the equipment and products that you can acquire through Regional Distributors, Inc. with flexible, simple, lease-financing alternatives are:

- Commercial warewashing machines (conveyors, under-counter machines, glass washers, ENERGY STAR certified, etc.)

- Janitorial products (cleaning carts, floor matting)

- Floor and carpet care equipment and machines (vacuums, autoscrubbers, burnishers, floor machines, carpet extractors, etc.)

- Restaurant and food service equipment

- Ice cream and frozen yogurt machines

Don’t see something you’d like to lease? Just ask! We have flexible leasing options for a wide range of products and equipment.

What is your lease-financing process?

* All lease-finances are subject to credit approval. Please contact us for more information.

Step 1 – Contact us to start the equipment selection and approval process. One of our Account Managers will meet with you to recommend equipment and structure a lease that meets your specific needs and budget.

Step 2 – Our leasing partner will send you their easy application to complete and return to them.

Step 3 – Receive a credit decision from our leasing partner within two (2) business days, along with lease-finance details and terms.

Step 4 – You will receive the lease-finance agreement from our leasing partner. Simply review, sign, and return. First and last month’s lease-finance payments are due upon signing.

Step 5 – We will order your equipment, deliver, and install, as applicable. You will make your monthly payments directly to our leasing partner.

Step 6 – Enjoy your new equipment, and put it to profitable use!

Is your lease-finance tax deductible as operating expenses or fully depreciable?

You have the option of both. You can either write off each payment or you can accelerate the depreciation in full. That is the beauty of equipment lease-financing.

Do you have a minimum amount for lease-financing?

We require a minimum $2,000.00 purchase to lease-finance with us.

Who is your third-party leasing partner?

Regional Distributors, Inc. is proud to partner with TimePayment Leasing to offer you flexible lease-finance options.

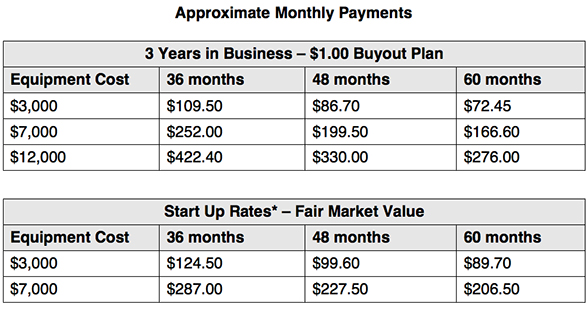

Equipment Lease-Financing Payments Examples

* New business (start up) rates may vary. All plans require first and last month’s lease payments upon signing. An origination fee may apply.

|